Using the KYCnow platform during the Corona crisis, we are able to help banks validate tens of thousands of requests for loans by businesses.

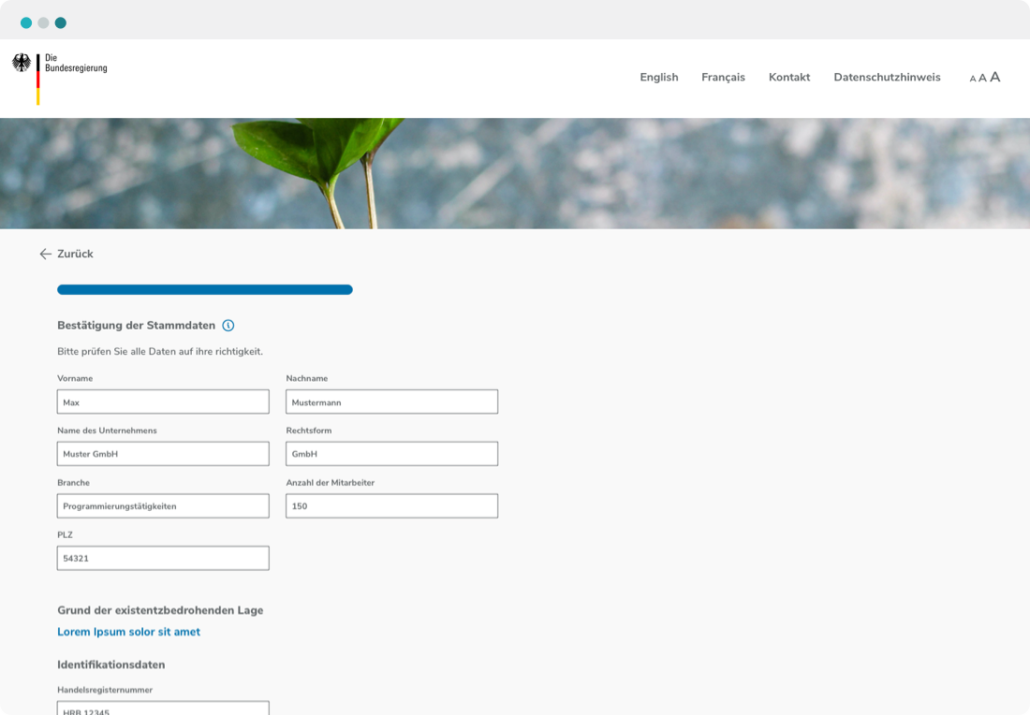

With an integrated solution for validating loan applications, ClariLab and SCHUFA are helping credit institutions to quickly disburse the new KfW fast loan program. It is aimed at small and medium-sized enterprises with more than 10 employees as part of the Corona assistance program. For the solution, existing products from the areas of credit reports, insolvency checks, fraud prevention as well as compliance were combined to form a new corporate credit report, the SCHUFA-B2B-Förderkreditauskunft.

The adapted KfW fast loan program is intended to provide small and medium-sized enterprises in particular with fast and unbureaucratic access to KfW loans. KfW – and thus the state – assumes a risk exemption of up to 100 percent for the new fast loans.

Fast validation of application details and protection against fraud

Due to the risk exemption, the issuing bank, which is usually the borrower’s bank or savings bank, no longer has to carry out a traditional risk assessment. However, the granting of credit is still dependent on whether the applicant meets the granting requirements.