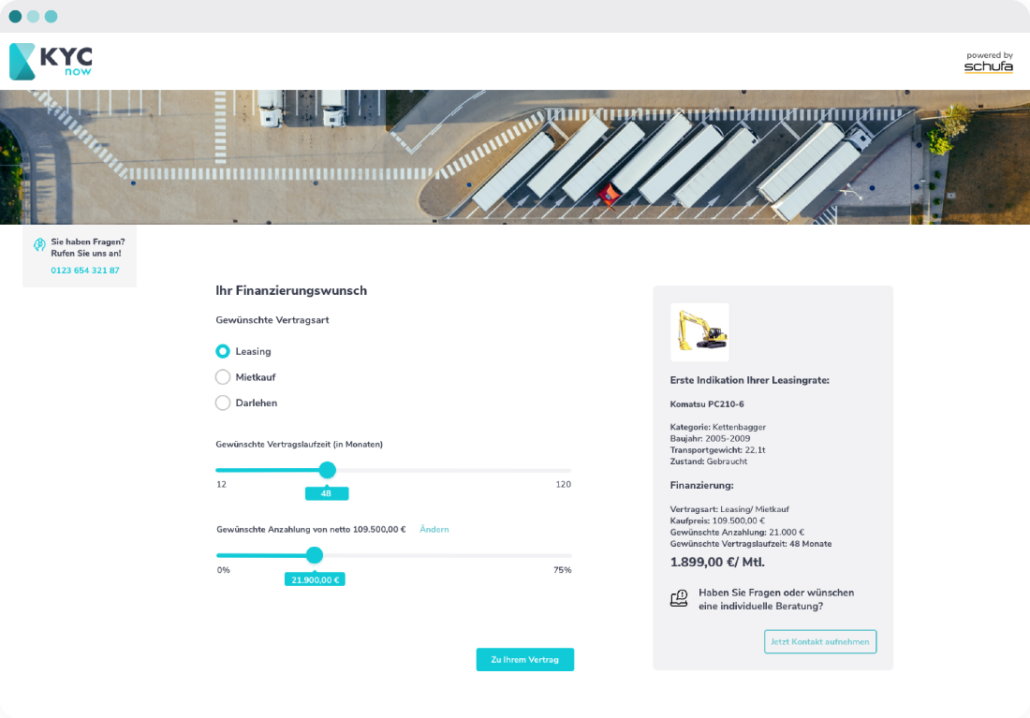

Object data, creditworthiness and money laundering risk. Leasing companies have to fulfill an extensive catalog of requirements until the contract is processed with customers. To meet these requirements, ClariLab, together with its partners SCHUFA and LECTURA GmbH Verlag, offers a digital, fully automated and case-closing process for the leasing application. Including final risk decision on lessee, object and supplier. Our advantage: The fully comprehensive service, from the application section with rate determination and risk assessment to the contract with GWG-compliant legitimation and qualified signature, is divided into just a few steps. The various modules can be used on a modular basis. The data set collected is available via our online application or can be integrated into the lessors’ systems via API.

Fast, simple, digital:

leasing application as a service

Smart application route with case-closing risk assessment

B2B leasing application in just a few steps

- Customer-friendly application process and clear customer journey

- Can also be used by vendors or agents

- Early use of knock-out criteria to avoid follow-up costs

- Few input fields – if possible with validation

- Pre-integrated third-party services: Machine and creditworthiness data, authorized persons, commercial register etc. fully automated already in the process

- Over 120,000 mobile machines (incl. residual values) already pre-installed in the object catalog

- Automated, media-interruption-free and GWG-compliant legitimation as well as conclusion of contracts possible

Later:

- Consideration of workflows with several participants

- Directly applicable – full integration into backend / ERP systems possible in a lean way thanks to interface preparation & integration services

With our digital leasing application, the risk decision regarding customer, object and supplier can be made in just a few minutes. Lessees, vendors or agents select the leasing object from a product catalog using an automatic proposal search and specify the desired financing model, term and down payment. Once the right company has been found, creditworthiness and company data are automatically checked and displayed once the user has registered. After the optional document upload and the final risk decision, the cabinet-ready contract can be concluded after legitimation.

Would you like more information?

We are happy to help you: