Today, the manual process of identifying and verifying persons should function completely digitally, but at the same time securely, in order to meet the requirements of the legislator and avoid possible fines. Obligated parties from the non-financial sector must prepare for significantly stricter regulations against money laundering and fines for non-compliance. According to §2 GwG, this also includes members of the real estate industry. The effort required for compliance with the documentation forms issued by the legislator is considerable. ClariLab and SCHUFA therefore offer their partners in the real estate industry a solution to comply with verification processes within specified deadlines and to identify and verify a counterpart in accordance with the “Know Your Customer” principle.

Money laundering prevention

for real estate agents

Safely avoid fines with KYCnow

Person verification and risk assessment in just a few minutes

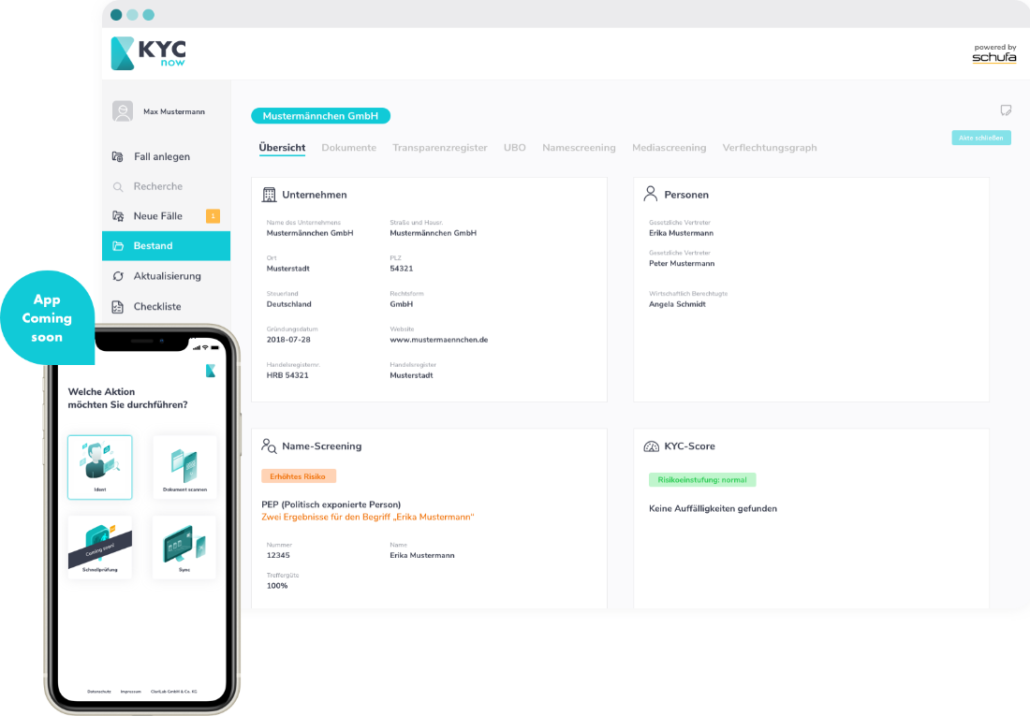

- KYCnow enables the Know-Your (KYC) process to be carried out on contractual partners of obligated parties in accordance with the Money Laundering Act.

- The scope of services includes identification, risk management and documentation.

- Regardless of the groups of persons or professions concerned under the AMLA, KYCnow adapts to the money laundering risk in relation to the contractual partner, the business relationship and the transaction.

- Personal data is checked and compared with 1,200 PEP/risk lists to determine the due diligence to be performed. You receive a location-independent, efficient and audit-proof

Would you like more information?

We are happy to help you: